tax lien sales colorado

It gives homeowners a chance to pay those taxes along with high penalty fees. For further information contact this office.

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

The Morgan County Real Estate Tax Lien Sale was held via the Internet November 16 - 18 2021.

. If you do not see a tax lien in Colorado CO or property that suits you at this time subscribe to our email alerts and we will update you as new. The following Tax Lien Sale Certificates may be purchased from Morgan County by paying the amount shown to the Morgan County Treasurer. Colorado is a good state for tax lien certificate sales.

The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS. For any questions about Tax Lien Sales please contact our office at 303 795-4550. The interest amount paid on the tax lien but not on the premium is determined on September 1 each year and is nine percent above the federal discount rate rounded up.

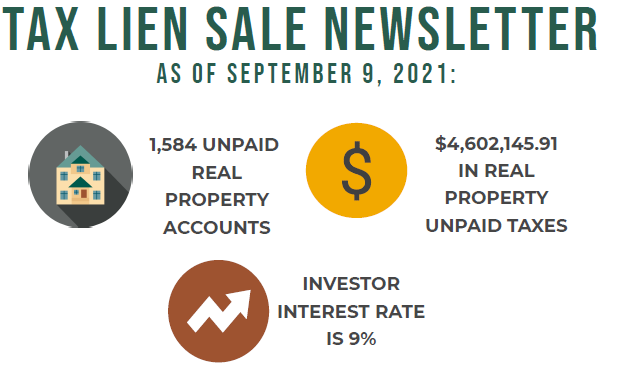

Tax Lien Sale Statistics. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. An annual Tax Lien Sale is held to collect the unpaid taxes.

A holder of a Tax Lien Sale Certificate has the right to pay all subsequent years taxes which remain unpaid after all due dates expire. Date Eligible for Tax Deed. These liens draw interest at the same rate of return as the original certificate.

For support call SRI Inc. If no one bids on the lien at the sale the county treasurer will strike off the unsold lien to the county or city town or city and county. The amount of the individual tax lien s.

San Miguel County Clerk and Recorder. 9 plus federal discount rate. 305 West Colorado Ave Telluride CO 81435.

Register for 1 to See All Listsings Online. Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. The Treasurers Office wishes to make it very clear that all sales are made with a buyer beware warning.

These taxes are purchased by investors who in turn earn interest on the tax liens against these properties. A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Those investing in tax liens do so at their own risk and are advised to exercise due diligence in carefully analyzing.

The tax lien sale is the final step in the treasurers efforts to collect taxes on real property. Ad Find Tax Lien Property Under Market Value in Colorado. Buyers must rely entirely on their own information judgment and inspection of the property records.

There are currently 40702 tax lien-related investment opportunities in Colorado including tax lien foreclosure properties that are either available for sale or worth pursuing. Check your Colorado tax liens rules. The sale will be administered by RealAuction and is conducted with the goal of fairness and efficiency.

CDOR will send a Notice of Intent to Issue JudgmentLien to the taxpayers last known address. These tax liens will be reflected on the tax lien sale record in the Treasurers office. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Colorado 2022 Tax Lien Sale Dates 2022 Tax Lien Sale Redemption Interest Rate - TBD Rates Set by State Bank Commissioner Sorted by County. A tax lien is placed on every county property owing taxes on January 1 each year and remains until. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid. If the property owner does not pay the property taxes by late October the county sells the tax lien at the annual tax lien sale. Many counties conduct their sales online or have a private company such as Realauction conduct the sales for them.

Colorado 2022 Tax Lien Sale Dates 2022 Tax Lien Sale Redemption Interest Rate - TBD Rates Set by State Bank Commissioner Sorted by County. Ad Get Free Instant Access To The US Tax Lien Associations 4 Module Online Course. This is a courtesy letter to allow the taxpayer one final chance to pay their tax debt.

As required by this statute each taxpayer meeting these criteria was notified by mail that failure to cure their tax delinquency could result in. In most states delinquent taxpayers get some time during which they can. Please check back for more information.

It is the buyers responsibility to know the quality of the property on which they are paying the taxes and receiving a lien. The sale is conducted on site as an open auction to the highest bidder. The Tax Lien Sale Site is open for registration year-round.

Twenty-nine states plus Washington. In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed more than 20000 for longer than six months. Search San Miguel recorded documents including property records death records marriage records and tax liens by name document type or date range.

The interest rate for the 2021 tax lien sale has been set at 9 by the State of Colorado Bank Commissioner. Here is a summary of information for tax sales in Colorado. View Tax Sale Information for detailed instructions on how the online tax lien sale works.

Purchase Price to 33122. The 2021 Tax Lien Sale will be held online on a date TBA. The Colorado Revised Statutes - 39-11-119 - provide that a holder of a certificate of purchase may pay any subsequent taxes on the property on which the buyer has an unredeemed certificate and that this payment will be endorsed on the certificate and the tax lien sale book of record in the Treasurers Office.

Tax Lien Sale Real property and mobile home delinquent taxes are enforced through the annual Tax Lien Sale. Ad Buy HUD Homes and Save Up to 50. The 2021 Tax Lien Sale will be held Wednesday November 10th on the internet.

Just remember each state has its own bidding process. Right to Redeem After a Tax Lien Sale Generally. Clerk and Recorder of Deeds.

So the county gets the certificate of purchase and can eventually get title to your home. The tax lien sale is held in the Kiowa County Courthouse on the first Wednesday in November. Phone 970728-3954 Fax 970728-4808.

16k Tax Lien On 1 500 000 Storage Units Colorado Tax Liens Online Auction Review Youtube

Real Estate Tax Deed Sales Title Search Tips On How To Avoid A Title Dispute When Investing In Tax Deed Sales Real Estate T Estate Tax Investing Sales Tax

10 Tax Lien Investing Pros And Cons Impact Marketer Investing Investing Strategy Real Estate Investing

Tax Lien Investing Pros And Cons Youtube

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Robot Check Real Estate Investing Investing Getting Into Real Estate

How To Buy Tax Liens Online Safely Successfully Click Here And Sign Up For One Of Our Educational Tax Sale Webinars Trade Finance Business Finance Investing

Tax Lien Information Larimer County

What Is A Property Lien This Debt Could Trip Up Your Home Sale Real Estate Investing Home Buying Capital Gains Tax

Pin By Blackpreneur On Money Money Money Money In 2022 Shopping

Tax Liens The Complete Guide To Investing In New Jersey Tax Liens Paperback Overstock Com Shopping The Best Deals On G Investing Books Bestselling Books

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

Larimer County Warns Of Tax Lien Scam Notices In The Mail Cbs Denver

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Tax Deed And Tax Lien Investing Ebook

How To Find Tax Delinquent Properties In Your Area Rethority

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And How Investing Ebook Series Training Video

List Of Liens From Class We Took Real Estate Investing Property Tax Investing